June Overview –

This month, I decided to do something fun – I challenged Lorne to make us a nice dinner on Saturday night. But perhaps first, a little background for context…

I am the one who prepares our weekly menu plan. I will ask Lorne if he prefers Caesar salad to Thai salad, or maybe roast chicken versus grilled chicken, but ultimately I am the one who chooses what we will eat each week. I also prepare the shopping lists as well as our “To Do/Defrost” list to make sure we either prep or defrost whatever is necessary, so everything is ready when we need to make it. Even though I make the weekly menu, Lorne does most of the cooking, so after work he simply consults our shared calendar to see what is on the menu for that day and then he heads to the kitchen to prepare it.

So, I thought it would be fun for Lorne to plan and prepare a dinner that I didn’t pre-plan. I gave him a budget of $100CAD ($73USD) – mostly because I was hoping for something nice – and on Saturday June 22, he headed to the store with an idea in his head.

After shopping, Lorne has to lug all the grocerie bags up to the third floor, and I am the one who usually puts everything away, but on this day Lorne asked me to stay out of the kitchen. He was concerned that if I saw what he bought, it would ruin the surprise. He remembered we had a large paper grocery bag under the kitchen sink, one we got eons ago and saved just in case we might ever need a large paper bag, and he packed all his special ingredients into it and put it on the top shelf in the fridge. No surprises spoiled here!

Around 5:30pm, Lorne headed into the kitchen to start dinner preparations. I could hear chopping and grinding, and pots and pans being used, and suddenly I could smell the most delicious aroma of garlic and butter. I knew then it was going to be delicious. It was near 7pm when he came to tell me dinner was ready. The whole house smelled amazing, but still I had no idea what he would be serving. I closed my eyes just as I entered the kitchen, taking in all the aromas and then opened my eyes to see Lorne standing on the other side of the kitchen island saying “Surprise”! He had music on, the lights were lowered, and had changed into a nice “going out” shirt. I felt extremely underdressed in my tank top and shorts, and quickly ran to the bedroom to put on something a little nicer. When I returned, he was serving up the first course.

To start, he had made Tuna Tartare (similar to Hawaiian Poke), that consisted of cubed, raw tuna that is seasoned with soy sauce, ginger and sesame oil. It was piled high on super thin slices of avocado, and some of the avocado was diced small and mixed in. To serve, he sliced up a baguette into small rounds for us to pile the tartare on. It was simply delicious! To pair with it, he opened a bottle of chardonnay that we had been saving for a nice occasion (such as this), and the wine went so well with the tuna.

For the main course, he made Shrimp Alfredo and served it over steamed broccoli. Lorne’s Alfredo sauce is seriously amazing, and I was very happy he used broccoli rather than pasta, to keep it from being a really heavy meal. It’s still super rich (you know, butter, cream, parmesan) but not as heavy serving it over broccoli. And it was absolutely amazing! Of course, the chardonnay paired perfectly with it as well. (Check out our Snippets for photos of this meal).

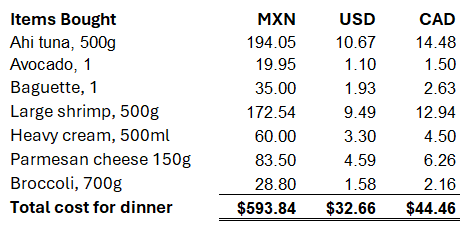

The next day we balanced up the cost of the meal to make sure he was within the budget that was set out – after all, staying within budget was also part of the challenge.

Lorne spent a grand total of $45CAD ($33USD) for our dinner ingredients.

Additional items he used, such as butter, condiments and seasonings, we already had at home.

The wine we enjoyed was La Crema Chardonnay from California. This wine normally runs for $479MXN ($35CAD / $26USD) but it was given to us as a gift, so no cost to us for this meal. However, had we purchased it, Lorne still would have been within the challenge budget. The total cost for our dinner at home including the wine, would have only been $80CAD ($59USD).

I was curious to see how this compared if we had gone out for this meal. Using one of our favourite local restaurants where we have previously enjoyed these dishes for comparison, I knew the cost of eating out would be more than eating at home, but I was surprised to see exactly how much more.

Tuna Tartare for two:

$49CAD ($36USD) – Local restaurant

$18CAD ($14USD) – At home

Shrimp Alfredo for two:

$67CAD ($49USD) – Local restaurant

$26CAD ($19USD) – At home

Had we gone out to eat this meal, it would have cost us approximately $116CAD ($85USD), before tax and tip, and this price does not include any beverages. We usually share a bottle of wine at this restaurant, so our final bill would normally run about $250CAD ($185USD).

Enjoying this same meal at home was roughly one-third the cost of eating out.

But of course, the big downside of eating at home to save money is that after finishing this delicious meal, we are the ones stuck doing the dishes… LOL!!

The whole evening was perfect, and it turned out even better than I had expected. Afterward, Lorne said he had so much fun working on this challenge that he wants to plan other surprise dinners for us down the road. I’m already looking forward to it.

The heat dome we were trapped under in May continued to hover over us for the first week of June, where our daytime high temperatures remained around 35C (95F).

The second week of June was a little different. On June 9, it was only 22C (71F) while eating lunch outside, then the next day, it was 35C (95F) outside. This happened again on June 13, it was 22C (71F) while having lunch outside, and the next day, it was 33C (91F) again.

After that our temperatures remained fairly constant and warm, but not crazy hot. Then in the last few days of June things started heating up for us again. Not surprised with July right around the corner.

Our average daytime high for June was 32C (90F), and the nighttime low was 22C (72F).

Retirement

The Reconciliation Phase

In our past blogs, we have talked about the transition into retirement, more specifically the common stages most people experience at some point in their journey:

- The Pre-Retirement Phase, where people begin to shift their focus from levelling up in their career to focusing on planning for retirement. When The Big Day finally arrives, you leave work for the final time, full of excitement and anticipation for the next chapter in your life.

- The Honeymoon Phase, turning off the alarm and experiencing that sense of release and relief. There are feelings of freedom and the sense that life is now open to so many possibilities. This is the time to spread your wings with new and exciting adventures and to take the opportunity to enjoy doing what you want, when you want.

- The Disenchanted Phase, where retirees begin to long for a sense of purpose. There are feelings of unmet expectations, disappointment, boredom and loneliness, especially if friends and family are still working. People adapt to their new daily routine but often lose focus on the things they were looking forward to in retirement.

- The Reorientation Phase, a crucial period for resetting expectations, adapting to change and embracing a more realistic outlook on retirement. It’s finding ways to enjoy retirement as it’s meant to be enjoyed, finding those things that give you meaningful purpose as well as some fun in your daily routine.

The fifth and final stage of retirement is known as the Reconciliation Phase. After the initial excitement, the shock, and the highs and lows of retirement have worn off, you finally feel like you are on the right path and are excited about the journey ahead. Your transition into retirement is complete and you find yourself settled into your new routine and lifestyle. You are enjoying your life with a new sense of purpose and identity. There is a renewed sense of hope for the future, a feeling of contentment, being positive and happy in your new life.

It is important to note that not everyone experiences each of these stages and each person’s experience may be different. For me, my Pre-Retirement was a total nail-biter waiting for COVID-19 to ease up so we could get our condo sold. The Big Day was of course a zoom meeting and a simple goodbye, the way things were being done during COVID. My first day of retirement was spent not sleeping in, but rather packing up our condo in preparation for our big move to Mexico. I missed out on the Honeymoon Phase as I became the project manager for our new home in a new country, and with so much to do it honestly felt like I wasn’t retired at all. The Disenchanted Phase hit me hard when the job I retired from ended up taking a big chunk of my self-esteem, and as well, I faced the struggle that I was no longer contributing financially to our household income. The Reorientation Phase helped me reset my life and establish a daily/weekly routine, which happily includes being able to enjoy a leisurely cup of coffee on the patio every morning.

The final stage of retirement, the Reconciliation Phase has not yet happened for me. In fact, I’m estimating it will probably be five or so more years before I am finally able to complete the last phase of retirement.

This is because Lorne is still working, and not ready for retirement yet. And of course, when he is ready to retire, he will need to proceed through the stages of retirement that will be necessary for him. Looking ahead, I am pretty sure he will enjoy an amazing Honeymoon Phase, getting to do all those things he loves doing (photography, programming, reading), but cannot find time for right now. I also think his Disenchanted Phase will be less than what I went through, and his Reorientation Phase will help him reset his expectations and find that daily/weekly routine that works for him.

Once he gets to that point, the two of us will be able to complete the Reconciliation Phase, transitioning into full retirement together, when we will finally have time to do those things that we love to do, both together and individually.

Retirement is not as simple as just not going to work anymore. It involves an ongoing process of emotional adjustment, while entering the last transition period in our lives. Each stage of retirement has its own unique set of challenges and opportunities. By understanding these stages, people can navigate the transition with confidence and resilience, ensuring a fulfilling and purposeful life during their retirement years.

June in Review

Election

Mexico’s General election took place Sunday June 2, when voters elected a new president to serve a six-year term, as well as voting in all 500 members of the Chamber of Deputies and all 128 members of the Senate of the Republic.

The incumbent president is Andres Manuel Lopez Obrador (simply known by his initials AMLO). He was the 65th President of Mexico, elected to office in the 2018 election.

During his time as president, he prioritized the funding of social programs, doubled the minimum wage, increased pensions and scholarships, and the unemployment rate hit a record low. His approval rate remained high – above 60% for most of his presidency.

Mexico’s president-elect is Claudia Sheinbaum. She won the 2024 general election by a landslide and received the highest number of votes ever recorded for a candidate in Mexican history.

When she assumes office in October, she will be the first female president of Mexico and the first president from a predominantly Jewish background. She is a scientist by profession and has authored over 100 articles and two books on energy, the environment and sustainable development. Prior to the election, she served as Head of Government of Mexico City (2018-2024), Mayor of Tlalpan – the largest borough of Mexico City (2015-2017), as well as Secretary of Environment of Mexico City (2000-2006). She will hold office for six years, until the next Mexican election, which will be held in 2030.

The Mexican Peso

The “Super Peso” as it has been referred to on social media, finally started slowing down in June. Mexico’s peso had gained 15% against the US dollar by the end of 2023 and was the strongest the currency had been since 2015. During the first half of 2024, the peso remained fairly high until the election on June 2, when it came under pressure and fell slightly, the first time since the spring of 2023.

Mexico’s peso is one of the world’s most-traded currencies and is the most-traded of Latin America’s currencies.

The growth of the peso is tied to many things, such as:

- Unemployment reached record low levels in October, and wages rose above the rate of inflation, leading to higher consumption of goods

- Local interest rates increased from 10.5% to 11.25%, which encouraged investors to buy the currency

- Record remittances from the US, have been predicted to exceed US$60 billion

- Fixed investments in plant, factories and machinery have increased

- The number of foreign visitors to Mexico rose by 15%, to US$60 million

For Mexico, the Super Peso is of course a good thing. For expats trying to make their foreign dollars stretch further, not so much.

When we arrived here in September 2020, buying something for $1,000MXN cost us $59CAD. In April 2024, that same $1,000MXN then cost us $83CAD.

Paying an additional $24CAD on $1,000MXN is one thing, but the bigger problem comes when we need to buy something for much more than $1,000MXN. For example, our kitchen renovation in 2021 was $238,275MXN, for which we paid $14,425CAD. In April 2024, when the peso was at it’s strongest this year, that kitchen reno would have cost us $19,825, which is $5,400CAD more just due to the exchange rate of the super peso!

After the election, the peso fell slightly and that $1,000MXN now costs us only $75CAD. It’s been interesting watching all the expat Facebook groups as they have become very excited and discussions are going back and forth to determine if now is the right time to start moving more money from their home countries of Canada and the US into Mexico, as this current rate is so much better than it had been only a few months ago.

Of course, getting that great exchange rate right now might feel like a win, but there is a downside to this too. If a lot of expats take advantage of these lower exchange rates and move more of their money into Mexico, it will simply increase the strength of the peso all over again! When it comes to foreign currencies and exchange rates, it seems sometimes you just can’t win.

ps… Don’t forget to check out the latest Snippets!

Your special surprise dinner sounds amazing. It’s so special that you take the time to do that for each other. More to anticipate I hope.

Enjoy your sharing and Lorne’s budget cooking challenge, my retirement I face is I have to create or learn new things to give me enjoyment and a sense of purpose. I enjoy catching up with the so many hobbies like playing the piano everyday for 5 mins and learn something new in music, woodworking, painting, renovation, gardening, and so many others. Good thing is this time I have no pressure to hurry and work for the clock or under someone’s authority. To put it simple, (no more rinse and reheat day , ) this is my favourite part of retirement

Loved your date night challenge! The mood lighting and the music were a nice touch 😆

Smooth moves, Lorne! Keep the challenges coming!

Super cool hearing about your new president and I really enjoyed reading your thoughts on retirement, mama.

The count down is on until we all get to celebrate together. 🍾

Only like 245 more sleeps!

What a great challenge! I love the use of broccoli over pasta. Inspiring!